How Long Will Housing Prices Rise Nationally?

Big questions still loom large in the world of real estate, one of which is: “How long will housing prices rise?” While none of us has a crystal ball, we can look to recent past trends and what experts are saying to arrive at a well-informed answer.

Here’s what we know.

Will the Current Seller’s Market Still Hold in 2022?

The hot, record-setting competitive year we saw in real estate in 2021 has maintained a strong seller’s market. The primary reason for this was the number of potential buyers outpacing inventory, which led to rapid price increases and even bidding wars in some areas. While this dynamic is expected to stay throughout 2022, higher mortgage rates will slow down the rate of price increases. It is even possible that we will see price drops this fall and winter, potentially even by late summer. Overall though, with the huge price spikes in quarter one of 2022, the overall year net will likely be positive.

As reported by the National Association of Realtors® (NAR), January 2022 saw an increase in existing-home sales over the previous month, which saw a decline nationally on a month-over-month basis. Taking a wider view of activity, they also reported that year-over-year, two regions in the U.S. saw sagging sales, one had sales increases, and another remained flat.

How Much Will Home Prices Increase in 2022?

The NAR went on to report that the median existing-home price for all housing types, nationally, in January 2022 was up 15.4% at $350,300 from $303,600 in January 2021 with prices rising in each region. This translated to 119 consecutive months of year-over-year increases, setting an all-time record. According to Kiplinger, Phoenix and Austin saw a 26% increase in 2021 with Las Vegas close behind at 25%—the top three U.S. cities with the highest gains in home prices. Tampa and Salt Lake were close behind that at 24%. (They report the Portland-Vancouver-Hillsboro area had a 17% increase.)

Realtor.com chief economist, Danielle Hale, expects U.S. price appreciation to grow by 2.9%, with Daryl Fairweather of Redfin in agreement, predicting prices will increase by 3%.

The NAR’s most recent Profile of Home Buyers and Sellers annual report shows that one-third of buyers paid above asking price in 2021 with first-time home buyers (on average, 33 years old) increasing to 34%, an increase from 31% in 2020.

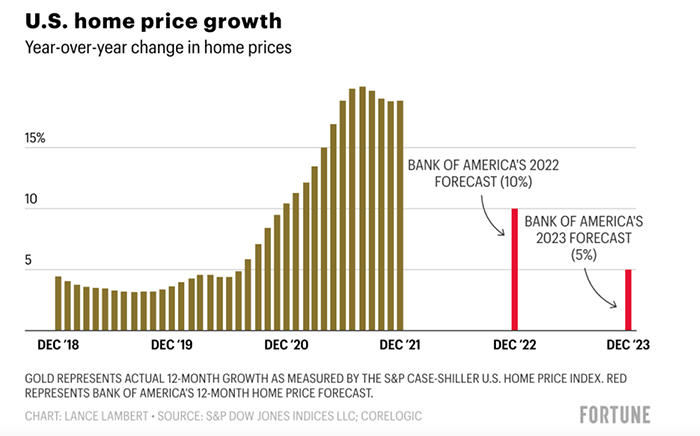

Bank of America posits that the rising rates will only cause buyers to rush in to make real estate purchases in an attempt to not be priced out as the year wears on. But, as they say, the market won’t be able to sustain the current number of buyers compared to available inventory. As we can see from the graph below, they predict a 10% increase in home prices for 2022, a noticeable drop from last year, and they predict an even lower increase in 2023.

So, this year will be the beginning of a shift from a seller’s market, and ultimately, the shift will be enough for buyers to reap the benefit. But it will be a slow process.

What Factors Will Determine Real Estate Prices in 2022?

Mortgage Rates

One of the reasons for the slowing down of sales in 2022 will be rising mortgage rates. It will simply put some people out of the running for mortgage loans.

Earlier this year Lawrence Yun, chief economist for NAR, projected that rates will increase to 3.7% in 2022. Fairweather and Hale both predicted 3.6%. And of course, they’re all wrong now. Rates are approaching 6% and expected to continue to rise.

As Fortune.com reports, swiftly rising mortgage rates, along with the persistent hot seller’s market and continued rise in home prices, we’re entering a state of economic shock. The result: many who were at the edge of qualifying for mortgage loans will no longer be able to. And those who can will find themselves not just strapped with higher interest but with an increase of $500-$1k+ per month more in a mortgage payment. The table below offers an example of how this might play out in real numbers assuming a 30-year fixed mortgage for $400,000 (from Fortune.com).

| Interest rate | Mortgage payment |

| 3.11% | $1,710 |

| 4.42% | $2,008 |

| 5% | $2,147 |

Rising interest rates coupled with rising home prices, up 18.8% over the past year, will undoubtedly price out many people wishing to buy a home in 2022 and will also likely slow investor activity.

While some are viewing the rise in rates a negative, Logan Mohtashami, lead analyst at HousingWire, says the rise is much needed to remedy what he calls a “savagely unhealthy” housing market.

Work-From-Home

The COVID-induced work-from-home trend caused a move by buyers to purchase homes sometimes far from their previous work locations and home towns.

With people more able to live where they like, those with affluence have relocated to more affordable areas, paying above asking price, thus driving up home prices and making it more difficult for locals to buy homes in their own cities.

Inventory

With new-home sales expected to rise to 920,000 in 2022 and existing-home sales expected to fall to 5.9M, we will likely begin to see things balance out and start to tip away from the hot seller’s market we’ve seen over the past two years.

What we can expect to see, then, thanks to increasing inventory, is a lessening in the amount of bidding war situations and high over-asking-price offers, at least starting this fall.

Want to Buy or Sell a Home in 2022?

Because we’ll see the beginnings of a shift in the seller-buyer power differential this year, it’s important to know how to be a smart buyer or seller in this climate.

The bottom line is that the current face of the national real estate market will shift in 2022. Slowly. And in general, homes listed in 2022 will stay on the market longer than they did in 2021. This doesn’t mean that potential buyers can rest on their laurels, though. If you’re a buyer and you find a home you love, it’s best to act swiftly and with the guidance of an experienced licensed real estate agent like our top 1% buyer’s team. Likewise, if you decide to sell your home this year, our top 1% seller’s team is here to help.

After nearly 20 years in the real estate market in the Portland metro area, we’ve seen it all. We’re sure we can help you navigate your way through your next real estate transaction, even in these unprecedented times.