Portland Real Estate Bubble – Housing Market Crash 2021

How did we get here? After COVID the Portland real estate market has been wonky. We had a 60% plus buyer traffic drop in March in 2020, then a full rebound by the end of July. Now in August the real estate market here is still hot but cooling some (which aligns with a normal seasonal trend). What will happen next in 2021? When I wrote my analysis of the Portland market in early 2020 before COVID hit, our housing market here was on FIRM footing. At the start of 2020 Portland wages rates were up, Portland employment rates were fantastic, new construction rates were down (keeps inventory tight and the market is less likely to crash), and Portland housing affordability rates were also up. Everything looked certain and good in the Portland real estate market at the start of 2020.

Will the Portland Housing Market Crash in 2021?

We are going to look at all the same factors the hold up any local real estate market: employee wages, unemployment rates, new construction rates, the current housing affordability rate, and population growth.

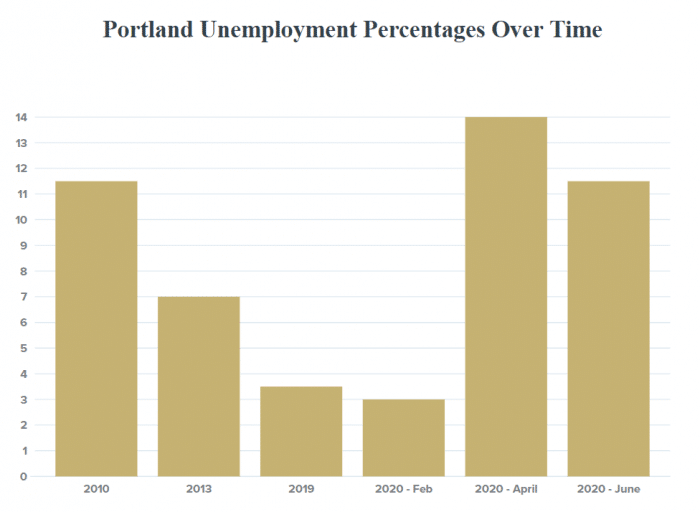

Portland Unemployment has Skyrocketed

At the start of the year 2020 Portland was sitting on a fantastic 3% unemployment rate. In April that number hit 14%, which was higher than back in 2010 (last recession) where unemployment in Portland was around 11% and you couldn’t hardly sell a house for trying. In June 2020 unemployment dropped from 14% to 11%, a big improvement in a short amount of time to be sure. However, there have been a lot of Portland businesses closing in July and August already. When the July numbers come out I’m not sure they will be much better. The real estate market in Portland started rebounding in 2012 when unemployment dropped to 8% and kept improving. In 2013 we had 6-7% unemployment, by 2015 we had 4-5% unemployment and then from 2016 to 2019 we had 3-4%. It had actually just ducked under 3% in Dec. 2019, the strongest in decades. You can check out all the numbers from U.S. Bureau of Labor.

Portland Wages in 2021

We don’t have official statistics yet (when you look online they are still pulling from Dept. of Labor’s last year reports), but what we do have is unemployment rates segmented down into job categories and we do know how much those job categories make on average in town. As one might expect Leisure and Hospitality unemployment in Portland is now at 36% and is the biggest driver of Portland’s 11% total unemployment rate. Nearly every other category of jobs have unemployment hovering around 5-6%. The only other major outlier is construction which has an unemployment rate of one-tenth of one percent! (Anyone need a job?)

Now wages in that Leisure and Hospitality category are historically LOW, averaging around $16 an hour, a far cry from the $28 an hour Portland was averaging in the last 2019 report. In other words, logic tells us that most workers in that category could not afford homes before and were not, for the most part, involved in the buying and selling of Portland real estate.

Unemployment is 5-6% for Job Categories that typically Afford Homeownership.

This is still very bad. A jump from 3% unemployment virtually across the board to 5 or 6% is not good for the Portland real estate market. But it is also not 2010 bad, which would be 11% unemployment across the board among potential homebuyers. A 5 or 6% unemployment rate is not 2016 – 2019 red hot Portland real estate numbers, but it is similar to the decent Portland housing market years of 2014-15.

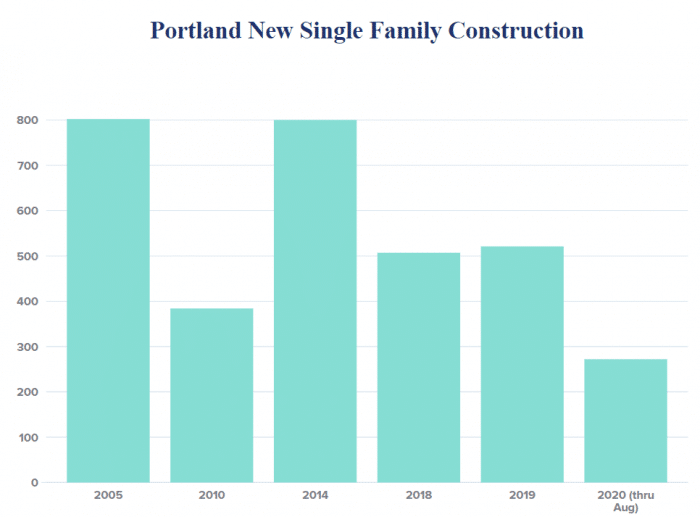

New Construction Rates will still be down in Portland in 2021

Yes, I know all about the Portland Residential Infill Project and that fact that any lot in Portland now can be turned into a six plex apartment building. If you didn’t know, it’s true and recently passed. This move will lead to some new affordable housing. But new construction is down in Portland for a lot more reasons than zoning. Did you see above, that construction unemployment is at one-tenth of one percent? Builders are having a hard time obtaining necessary labor. City permit costs for new construction are up. Demolition permit costs are up. Building material costs are up. Labor costs are way up. If home prices don’t significantly climb (and I do not think they will) then building costs are up regardless of new zoning opportunities and you won’t see much new construction in Portland for the same reasons we haven’t seen much in the last few years.

Few New Homes Available, Lots of Empty Apartments to Choose From

Apartment vacancy rates are climbing in Portland and are near 8% now with lots of new apartment buildings still set to open this year and into 2021. The lack of new single family homes available for sale will keep demand high in that segment (not in the condo market).

Portland Housing Afforability Rates

Housing affordability rates are determined by comparing local average wages with local rents or home prices. If a person can spend 30% or less of their income on housing it is deemed affordable, if it takes up more than 30% of their income, housing is deemed affordable.

The average wages (again we do not have the latest numbers here, but most assume those that have been able to keep their jobs in large part are earning similar wages) for Portland are roughly $73,000 a year, which means they can afford $1825 a month for a mortgage or rent payment.

The median price of a Portland home right now is $450,000. This would make principal and interest payments fall in the affordable category, $1,802, but when you add taxes and insurance it pushes past affordability to $2,579. This does not include utility costs.

The average monthly rent in Portland right now is $1,975 making it higher than 30% of a worker’s income. This does not include any insurance or utility costs.

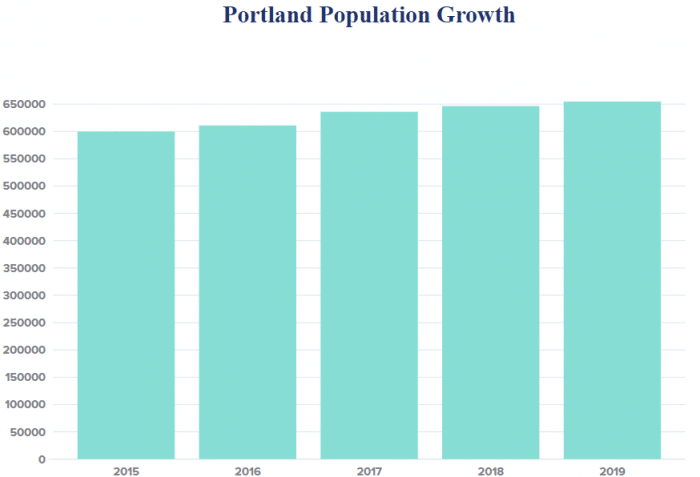

Portland grew slowly in 2019, but will it grow at all in 2021?

According to Portland State University research, Portland city proper grew by 1.3 percent in 2019 which is moderate growth for any city center in the U.S. The greater Portland metro area has a slightly higher growth rate, but it was still moderate for a metro area in the U.S. 2020 population growth charts should be out soon. You can see in the chart below that population growth has been slowing in Portland city proper for a while.

Specific COVID Impact on the Real Estate Market

Motivation to move is a significant market factor, and due to COVID that motivation is HIGH. First time home buyers are out in force, trying to escape the high population density in apartment complexes. Home buyers are looking for private yards, bigger homes, amenities and more space in general. This is compounded by more people working from home and public school in Portland being taught online. Everyone is stuck at home together and many people are finding they want to be stuck somewhere else, they have HIGH motivation to sell and buy a different home or buy their first home. I believe this is why the Portland real estate market rebounded so quickly in 2020 from COVID’s initial impact. I also believe this motivating factor will stay high for some time to come and we may have a fairly stable and strong fall and winter market in 2020 – due to this factor alone. Really strong buyer motivation is not enough though, on its own. You also have to have a job and make a wage high enough to afford what is available.

Will the Portland Housing Market Crash in 2021?

No. Given the local economic factors above there is no reason to see a real estate market crash in 2021. Let me summarize for you. Unemployment will be up, but not unreasonably high, for job segments that can typically afford homeownership. New construction rates are very low and are likely to remain so, keeping inventory down. Housing affordability rates aren’t great. They are just above what is possible for the average solo working person in Portland, but for two workers making average wages in town, a home or apartment is easily affordable. Portland population growth is slow and could, for the first time in ages, potentially be stagnant or even decline (unlikely) in 2021. COVID has given many people a strong motivation toward buying or selling a home. This mix of local data does not equal a crash.

But there is a good chance housing prices will decline some and overall sales will go down. The only reason there would be a housing market crash in Portland in 2021 would be from national or international economic factors at play. Locally, from our Portland numbers here, a market crash is not in the cards, merely a slight slowdown.