Portland Real Estate Foreclosure Rate – 2020 Report

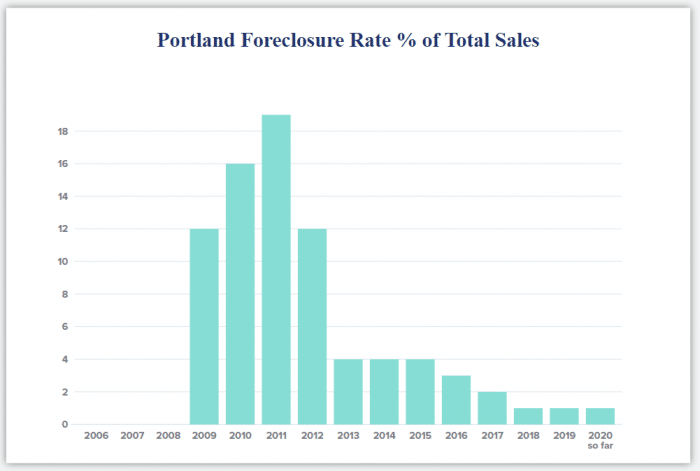

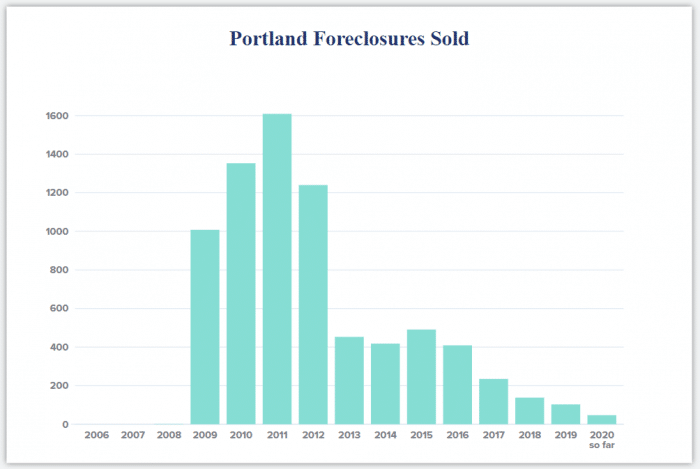

Over the past five years, the foreclosure rate in the Portland real estate market has been dropping, from close to 4% of total sales in 2015 to just under 1% this year. Even though the total number of foreclosures in Portland has gone down, we’re not back to zero foreclosures, which was the case prior to 2008.

Last year, homebuyers successfully closed on just over 100 foreclosure deals (according to RMLS, our local MLS system) and 47 foreclosures have closed already in 2020. But the COVID-19 pandemic prompted lawmakers this spring to prohibit banks from pursuing new foreclosures until at least October. What will this mean for the Portland real estate foreclosure market? We can take a look back to the last significant event to hit the Portland real estate market, the 2008 crash, to get some insight.

Portland Foreclosure Rate: Delayed Reaction

As the above chart shows, the foreclosure rate for Portland homes went up significantly after the real estate market crash of 2008. The peak happened, after a bit of a delay, in 2011, when foreclosures made up close to 20% of total sales. In other words, 1 in 5 homes that were sold in Portland that year were sold as foreclosures.

A foreclosure happens when a bank or mortgage lender exercises their right to recoup their investment by selling the home. During downturns in the real estate market, homeowners can see the value of their home shrink significantly, causing the mortgage to “underwater”. If that coincides with a lost job because of an economic crisis, homeowners tend to stop being able to make payments on their mortgage. That’s when banks typically get busy making foreclosures. In Oregon, most foreclosures are non-judicial, meaning they happen without getting the courts involved.

But that doesn’t mean Oregon foreclosures happen quickly. That’s the reason why, after the last market crash in 2008, it took until 2011 for the rate of foreclosures to peak in Portland. Then, starting in 2013, we saw a significant drop in the number of foreclosures as the economy stabilized.

Will the foreclosure rate go up again due to COVID?

That’s what everyone wants to know. Foreclosures can represent a bargain for home shoppers because foreclosed homes usually sell below current market value. But buyers looking for foreclosure deals should not hold their breath!

In Oregon, the foreclosure process can’t begin until a mortgage holder is 120 days late on payments. Then, the bank must provide 120 days’ notice before foreclosing. So, at the very minimum, the length of time for a foreclosure in Oregon is going to be 240 days, or about 8 months. Up until 5 days before the foreclosure happens, the homeowner may come up with the missing payments and reinstate the loan, bringing the home out of foreclosure. Then the whole process must begin again, assuming the homeowner returns to not making payments. The homeowner can also take the lender to court to dispute the foreclosure proceedings, delaying the process.

As we mentioned earlier, foreclosures on FHA loans were banned beginning in March 2020. Then, in late June, Oregon lawmakers passed a bill to extend the foreclosure moratorium through September, and longer if the governor approves. But even if foreclosures do start happening again later this year, it will likely be a slow trickle onto the marketplace, starting in 2021 and peaking three or even four years from today.

Nonetheless, the Portland real estate market is still in recovery from the big drop in buyer activity this spring. There are still many “forced sellers” on the market who aren’t going into foreclosure, just selling because of changed life circumstances. Meanwhile, mortgage rates are historically low. For those looking to invest in a home in Portland, the summer of 2020 might be the perfect time to buy.