Portland Real Estate Market Forecast 2021 – A Boom Year

Each year we research and put out two Portland real estate market forecasts, one in the fall prior and one in January of the new year. Every year until now those two forecasts have lined up fairly closely. In 2021 we have a different story to tell. First off, it is important to realize that when you have an ever-changing powerful force (like a worldwide pandemic) normal factors that make for an accurate real estate forecast can be easily blown off track. Now that we have had enough real estate market time dealing with COVID19 and we have a clear path to a vaccine, it has become much easier to forecast than it was this fall.

Quick summary to catch us up to speed on the Portland housing market. In Portland’s recent real estate history, prices dropped from 2008 to 2011, then increased from 2012 to 2016 (at an incredible pace). However, 2017 – 2019 the Portland real estate market was only seeing modest gains. In 2017 through 2019 certain segments of the local market even dropped in price (luxury and condo). Overall housing affordability was on the rise in Portland according to every chart as housing prices slowed and wages increased much faster. Then came 2020. The first half of 2020 was a mixed bag, but the second half of the year was defined by low inventory and fast-rising home prices. Portland housing prices ended up increasing a whopping 7.1% by the end of 2020.

National Real Estate Market Forecasts 2021

Zillow Research = 10.3% Home Price Increase

Realtor.com = 7% Home Price Increase

Corelogic = 2.5% Home Price Increase

Freddie Mac = 2.6% Home Price Increase

VeroForecast = 5.9% Home Price Increase

Portland Real Estate Market Forecasts 2021

Zillow Research = 10.4% Home Price Increase

Realtor.com = 6.2% Home Price Increase

My prediction = 5% Home Price Increase Overall. I will segment that down depending on the type of property you own below.

Why 2021 Real Estate Forecasts Vary More than Usual

From 2.6% to 10.3%, there is a big difference of opinion from major real estate industry players on what will happen nationally next year, more than usual. I do not believe this is from the normal supply vs. demand numbers, which are very favorable for a boom year in 2021. I believe this pricing discrepancy is due to the number of homes in mortgage forbearance (homeowners not paying their mortgages right now). According to HousingWire.com’s research, a whopping 5.49% of homeowners are in forbearance right now. Those homeowners, unfortunately, could turn into short sale listings or foreclosure listings and both of those types of properties sell for much less on the real estate market. So the more foreclosure and short sales hit the market, the further the average home price in the area gets dragged down. Foreclosures from current forbearance wouldn’t be likely to hit until 2022, as foreclosures often take a year or longer to hit the market, but short sale listings could start right away in 2021 as folks who can’t pay suddenly have to or face a looming foreclosure. (Typically short sale situations are better for homeowners in the long term than foreclosure.) So I believe mortgage-related companies like Freddie Mac that are vigilantly watching forbearance rates have lower overall price expectations for 2021 and companies like Zillow that focus on supply vs. demand numbers have higher estimates. Regardless, if you are not likely to face a short sale or foreclosure situation, your property price is likely to greatly increase in 2021. You’ll also notice that every national forecast is positive per housing price increases. I do expect there to be a certain number of short sales in Portland in 2021 and that will drag down the housing price average a touch.

Your Home’s Value Forecasted for 2021

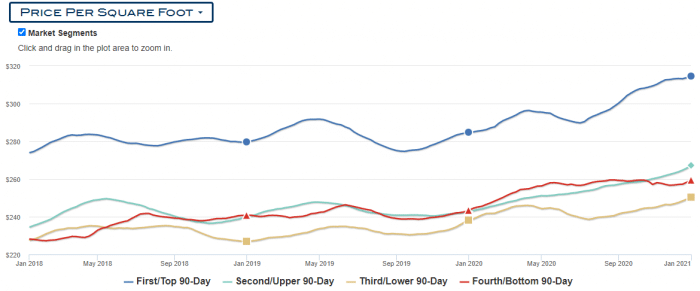

The type of home you own, luxury, fixer, condo, or townhome will appreciate at different rates in 2021. Below we are breaking down the forecast by pricing from top 25% in price to bottom. Then we also pull out condos for a separate Portland condo market forecast. We’re going to show you incredible real estate market charts along the way so you can see the data for yourself. All the charts that follow can be credited to Fidelity National of Portland.

Portland Luxury Home 2021 Forecast – Top 25% Housing Price

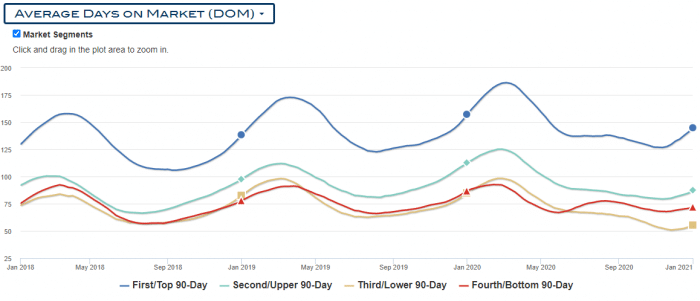

Right now a top 25% priced home in Portland averages $1,325,000 sales price at 4,181 average sq. ft. sits on a quarter to half acre lot and has four bedrooms and four bathrooms. The average time to sell at the moment is 179 days.

Top 25% Luxury Home Forecast 2021 = 10% Price Increase

Luxury Portland homes are doing very well, actually outperforming the remaining three real estate market segments. This demand for luxury housing is being driven by COVID19 lifestyle choices. As more working adults are finding themselves working at home and families with children are taking school online at home – the demand for more sq. ft. and for luxury home amenities has skyrocketed.

Price Per Sq. Ft. Chart for all Four Housing Segments.

Top 50% Housing Price Forecast 2021

Right now a top 50% – 75% priced home in Portland has an average price of $799,000 and is 2,978 sq. ft. on an average 5,000 sq. ft. lot or slightly above average. The home has four bedrooms and three full baths. The average time to sell at the moment is 110 days.

Top 50% to 75% Housing Price Forecast 2021: 6% Price Increase

We are seeing many home buyers also purchase in this segment for the first time, buying step-up homes that are larger and have more amenities than their previous home. Similar to homes in the top 25% segment we do not expect to see many short sales or foreclosure situations in this segment.

Bottom 50% Housing Price Forecast 2021

Homes in Portland in this category have an average price of $590,000 and are 2,319 sq. ft. in size with three bedrooms and two full baths on an average sized lot (5,000 sq. ft.). The average time to sell at the moment is 74 days.

Bottom 50% to 25% Housing Price Forecast 2021: 5% Price Increase

This segment, like the others, is seeing move-up buyers and is also full of first-time homebuyers purchasing bigger and better homes than they might have considered previously. We will likely see a few short sales in this category.

Average Days on Market for all Four Segments

Bottom 25% Housing Price Forecast 2021

Homes in Portland in this range currently average $389,000 in price and are 1,374 sq. ft. with an average of three bedrooms and 1 bathroom on an average size lot. The average time to sell at the moment is 83 days.

Bottom 25% Housing Price Forecast 2021: 3% Price Increase

There are plenty of first time homebuyers purchasing in this category. The only factor that may keep prices down in this segment is the threat of upcoming short sales and foreclosures in 2021. It is likely that the majority of distressed residential property sales will occur here.

Portland Condo Market Forecast 2021

The Portland Condo Market vs. the Portland Housing Market is a study in contrast. They are wildly different from one another. While Portland housing prices shot up in the second half of 2020, Portland condo prices remained flat. While Portland homes have been selling faster and faster with low inventory, Portland condos time to sell has remained slow across all four pricing segments.

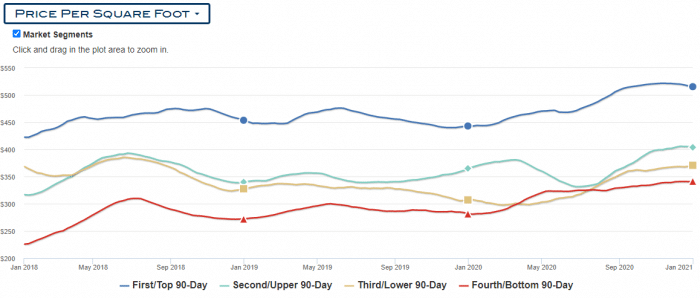

Portland Condos Price per Sq. ft.

You’ll notice from May of 2018 to Jan. of 2021:

Luxury condos have had some price increase, but it is modest, $465 vs. $515. Condos priced in the mid-ranges, 25% to 75% have hardly moved at all, basically remain the same price. The bottom 25% has seen decent movement, from $309 to $342.

I’d expect Portland luxury condos to appreciate 5% in 2021. I’d expect all mid-range condos to remain flat in 2021 and the bottom 25% of condos to also appreciate about 5%.

Summary

Expect low inventory to plague the Portland real estate market at least through August of 2021 (except for the condo market). The housing market will remain a seller’s market throughout 2021 and the Portland condo market a buyer’s market. If you’re looking for a top real estate agent in Portland to guide your next real estate purchase or sale, contact us today.