Top 5 Real Estate News Stories of 2021 So Far

As much as we may be sick of hearing about it, the long and the short of it remains that Covid-19 continues to dominate the biggest real estate news stories. While some aspects of the market are undeterred by the pandemic – buyer demand, notably – others remain markedly affected. As 2021 unfolds, the virus still complicates real estate trends.

Today we’re rounding up the top five real estate news stories. But we’re also parsing how national trends intersect with local ones. From the Federal Reserve’s interest rates to the government vaccine roll out, let’s take a dive into how the Portland real estate market has been affected by national forces, local idiosyncrasies, and a global pandemic.

1. Record Low Interest Rates – For Now

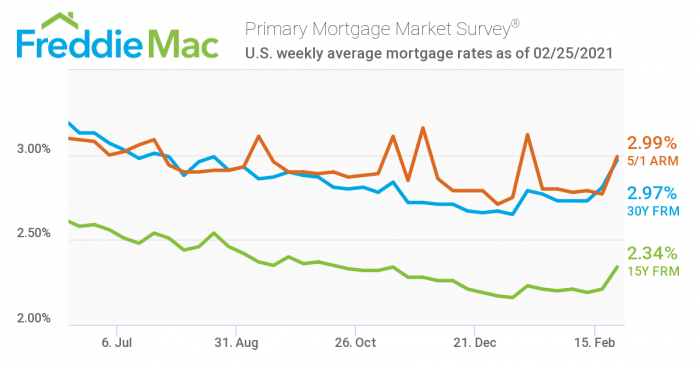

On the whole, interest rates fell throughout 2020. According to Freddie Mac data, though, they hit a historic low in January of 2021 at an average of 2.65% for a 30 year fixed mortgages. These are some crazy low numbers! While high demand in Portland is driving home prices up, these low rates may spell high savings for new home buyers.

That being said, the tides may be turning. The last two weeks of February saw a sharp uptick in interest rates. From the historic January 7th low, we’ve seen an increase of 0.6% – not insignificant. But the real story here is how steeply interest rates rose in the final week of February. You can see the evidence in the graph above, but if that isn’t enough for you – in one week the increase in interest rates spiked by 5.7%.

We include this story because it’s one that is really still unfolding. Why the sudden uptick? Freddie Mac credits it to optimism for the strength of the economy. The vaccine roll out may be pushing this optimism, or it could be the change of administration. We don’t like to get too political here – an increase in interest rates also accompanied the last administration’s rise – so the full implications of this pivot remain to be seen.

2. Delayed Inventory of Homes for Sale in Portland

Inventory of homes has also seen a record low recently, and the explanation for that can’t be boiled down to one answer. We rode a roller coaster ride of reasons why in early 2021. Are there simply fewer homes on the market? Or is consumer demand is simply so high that the inventory is flying off of the metaphorical shelves too quickly?

But one theory stands out among the crowd. It’s possible that plenty of folks have been thinking about selling their homes for a while, but put their plans on hold due to Covid-19. The implications of that trend could result in a huge shift in the market during 2021. Right now the Portland real estate market is still solidly in favor of the seller (with the exception of condos). But once the vaccine is in more arms, which may be sooner than you’d think, homeowners who hesitated before may be ready to make the move. That could trigger an influx of homes on the market, and shift the balance drastically.

3. Federal and Oregon Foreclosure Moratoriums Keep People in Their Homes

Of the many challenges brought by the pandemic, one of the muddiest is what to do about evictions and foreclosures. For Oregon, protections for homeowners remained a strong priority, with Governor Kate Brown’s Executive Order 20-37 prohibiting foreclosures through the end of 2020.

Fast forward to 2021, and Oregon lawmakers have extended the moratorium on eviction of renters, but not chosen to consider legislation concerning foreclosures.

On February 16, though, the Biden administration announced protections from foreclosure through June of 2021. The good news for both Portland homeowners and Portland banks, though, is that the foreclosure rates in Oregon are at a fraction of the national rate, even as national rates hit lows due to Covid-19 protections.

4. The Rise of the Zoom Town

This one might not come as much of a surprise to many Portlanders. For years now Portland has welcomed an influx of Californian migrants, who are able to work from home for a fraction of the real estate price of Silicon Valley, for example. But the pandemic has thrown a new wrench into the works: instead of seeking out city amenities, some folks are looking for access to the outdoors.

Bend, Oregon in particular has become a hub for those who can work from home. In this fluctuating and increasingly virtual world, what once made a boom town – local industry an resources – is becoming a Zoom Town. The luxury of Bend’s access to the outdoors is increasingly attractive right now as folks seek outlets from quarantine life. Home values as a result are increasing at a strong pace in localized areas. But in truth, we think this makes more of a national story than a local one for Portland, since Portland has already felt the slow burn of this trend over the years.

5. iBuyers Make a Comeback – But Not for the Consumer

After taking a break for about a month during the pandemic’s onset, iBuyers came back strong in the latter half of 2020. And the trend seems to keep going in the first quarter of 2021. There are plenty of reasons why people find selling their home through an iBuyer attractive. Namely, they claim convenience and a quick sale. And as we mentioned above, many homeowners have likely been sitting on homes they intended to list, waiting out the storm. So it’s likely many sellers will continue to view iBuyers as an enticing alternative.

However, as we recently outlined, iBuyers are generally not the best option if you’re looking to get the most out of selling your home. They typically charge shockingly exorbitant fees, and they employ shady tricks such as suddenly dropping the price of your home just before closing. Especially for the Portland market right now, which is seller friendly, the best option is to use a trusted real estate agent. After all, haven’t many of us already spent too much time online this past year?

Make Your Own Portland Real Estate News Story

The most striking real estate news will always be for the individual: when you buy or sell your home. At a maximum of 4.25%, which includes buyer’s agent commission, we offer reasonable rates and excellent results. We list on multiple MLS systems and pay extra to the top real estate portals to feature your home above others. Check out our top 1% sellers agents and top 1% buyers agent, who are ready to assist you.