Top 5 Real Estate Market News Stories of 2022 so Far

We keep track of what’s going on in the world of real estate, both near and far. We wanted to see how it all looks now that we’re about to move into the second quarter of the year.

We get that times are strange in real estate right now, but it’s a great time to buy, considering what’s likely coming down the pike.

While price increases and low inventory are not news, there’s plenty more going on that’s worth your attention. Especially if you’re thinking of selling or buying in 2022.

1. The Fed’s Rate Hikes Will Affect Real Estate

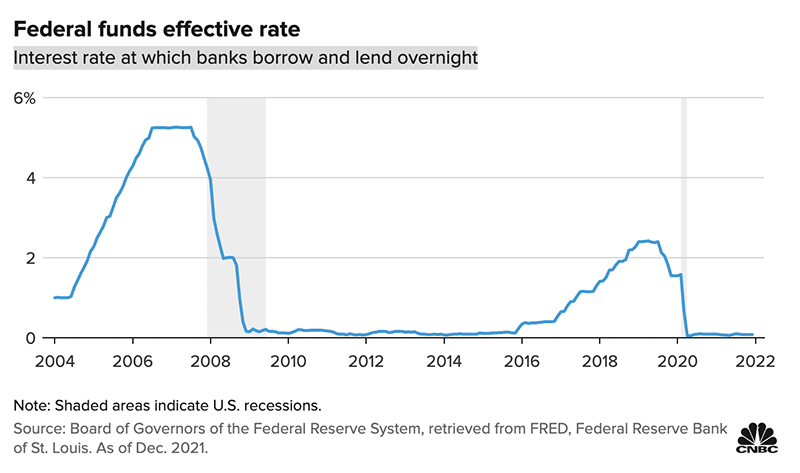

The Federal Reserve just approved a 0.25 percentage point interest rate hike, the first since December 2018, with six more planned throughout 2022. So, what does this mean for the real estate market?

First, it helps to understand what the Fed’s rate is: the Interest rate banks use to borrow and lend overnight. The image below shows the fluctuation in the rate since 2004.

What the hike means in real estate is that borrowing will get more expensive. With mortgage rates expected to keep increasing throughout 2022, this new hike will impact those wanting to buy homes.

The increase will more immediately impact people with Home Equity Lines of Credit, which can adjust immediately to rate changes. It will also impact those with Adjustable Rate Mortgages (there are fewer of these out there), which adjust once per year, dependent on the rate at the time.

Now is the time to buy a home or refinance to a fixed rate, as six more rate hikes are predicted in 2022!

2. Rising Interest Rates Have Multiple Effects on the Real Estate Market

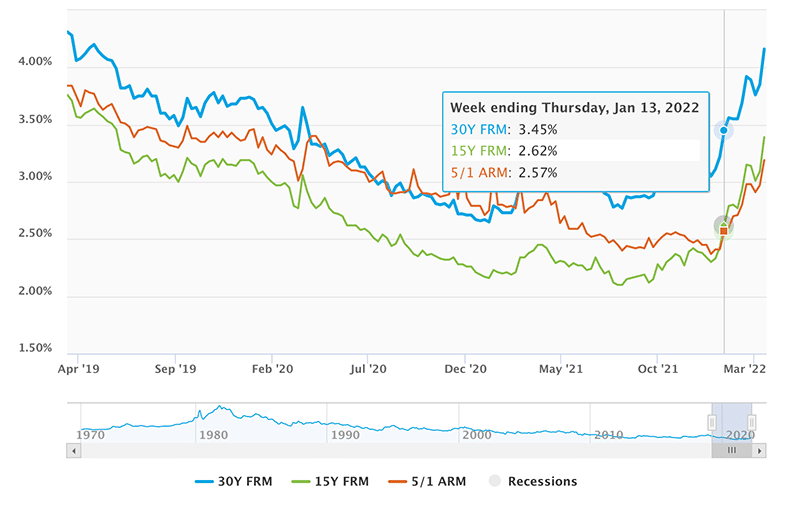

In addition to the Fed’s rate hike, mortgage interest rates have been increasing since the fall of 2021. When we think of interest rate increases in real estate, our minds first go to the effect this will have on home buyers and their ability to get financing or afford monthly mortgage payments.

But home builders are also affected by interest rate increases. Builders’ sales expectations dropped a drastic ten points for the next six months. Higher interest rates mean fewer people interested in building, which means less work for builders. This comes after months of supply chain issues that also put a hefty ding in new construction projects.

New construction isn’t the only market segment being affected. Cnbc.com reports that “The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 4.27% from 4.09% for loans with a 20% down payment.” This means that we can expect to see a decline in overall mortgage demands this year, as well.

The graph below, provided by FreddieMac.com, shows the fluctuation in mortgage rates for the past three years. As we can see, rates are on par with where they were in 2019. And they’ll keep rising.

3. The Spring Real Estate Market Could go Either Way

We’ve written about the likelihood of a “brutal” spring market, based on low inventory and high buyer demand. These predictions are, of course, playing themselves out right now with massive price increases and bidding wars. See the image below for the March 2022 active listings report for the Portland real estate market.

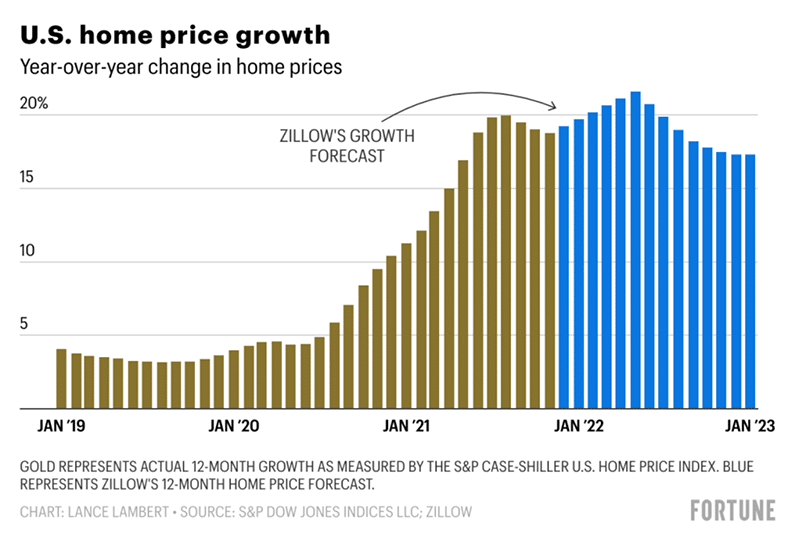

Even after Fortune predicted that home price increases would slow down, they’ve changed their tune, based on Zillow’s findings and projections, shown in the graph below.

With all things real estate seeming to be up in the air right now, there are ways for buyers, especially first-time buyers, to get themselves into a home in 2022.

Right now we are betting on a continuously hot spring real estate market and a cooler than expected late summer and fall market due to multiple expected interest rate hikes and increased inventory that always comes with the changing seasons.

4. Affordability is a Concern for Most Home Buyers

With good reason, potential buyers have affordability concerns. The U.S. News & World Report March 2022 survey reports that of the 50% of all people surveyed who stated an interest in purchasing a home in 2022, 23% were concerned about affordability, while 27% were concerned about availability.

The report goes on to say that over 70% of those interested in buying a home are optimistic, nonetheless with 48.3% wanting to buy their first home, 18.9% wanting to sell and buy, 10.4% wanting to buy a second home, and 22.4% wanting to refinance.

Concerns about both are legitimate, given the current climate, even in the Portland metro area. But as we say above, all is not lost for first-time home owners in Oregon.

Read more about the current state of housing affordability in Oregon from Portland.gov.

5. Homeowners Made More from Owning their Homes than from Their Jobs in 2021

It’s true! According to the Wall Street Journal. A recent article reports that several factors came together to create an environment wherein home owners made more money on their homes than they did from their income in 2021. The factors that contributed to such a high-sales year were:

- inventory remained low

- incredibly low interests rates increased buyer demand

- remote work made it possible for households to relocate to lower-cost housing markets and outbid locals

- single-family real estate investments increased

Is Now the Time to Buy or Sell a Home in Portland?

We hope so! Because the market is going to see some changes this year that could lead to less money in your pocket long-term. Let us use our almost 20 years of experience to help you navigate these wild, unpredictable times in real estate. With our customer-first approach and our knowledge of the area and the world of real estate in general, we’re sure we can help you create as stress-free a process as possible. Give our top 1% buyers team or our top 1% seller’s team a call today or chat with the bot on our site. We look forward to talking with you!