Top 7 Real Estate News Stories of 2021

COVID-19 has, without a doubt, impacted the real estate market from decreases in interest rates and inventory to increases in zoom towns and home prices. While we are still not out of the woods with the pandemic’s influence on the market, we’ve been watching to see how it’s all unfolding.

We’ve consulted some of the top sources in the country to see how things look on the national real estate landscape. While COVID has been front and center in all news, including real estate, it’s not the only news.

Here, we’ll share what’s happening across the country and here at home to help you stay informed whether you’re just entering the market for a new home or have been following the trends for some time.

1. Volatile Interest Rates

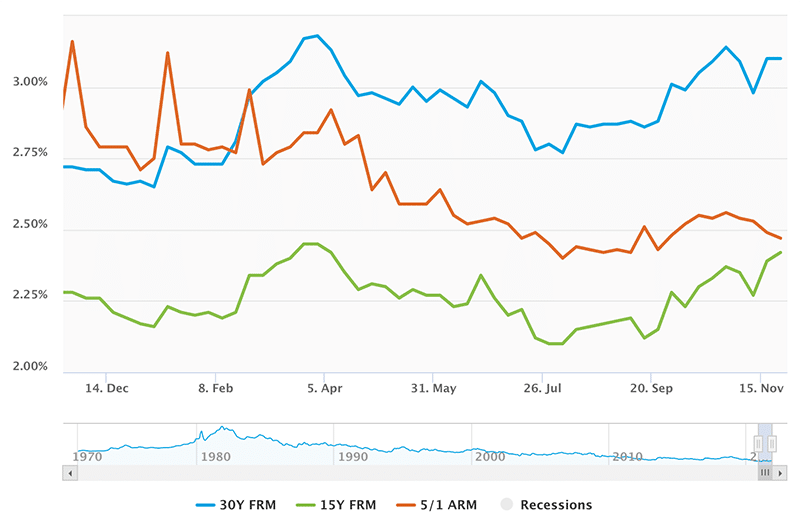

In July of 2021, we wrote about the significant dip in interest rates in January to a historic average low of 2.65% for a 30-year fixed mortgage. As we said then, the mortgage interest rate scenario is still unfolding, and after the spike in rates of 5.7% in one week in February, we’ve kept our eye on it.

As FreddieMac.com reports, interest rates were holding steady into the recent Thanksgiving holiday. CNBC.com reports that mortgage rates rose nationally by 15 basis points during the past three weeks, which in turn, reduced any refinance incentive for potential borrowers by 18%, according to Joel Kan, associate vice president of economic and industry forecasting with Mortgage Bankers Associations.

Now, with the introduction of the new COVID variant, Omicron, National Mortgage News posits that mortgage rates could drop again, as they did with the Delta variant, although Jeff Tucker, senior economist at Zillow, expects the impact on mortgage rates will be temporary and doesn’t foresee any significant impact on the overall real estate market.

2. Low Real Estate Market Inventory

Earlier this year, we wrote about the problematic decline in inventory in the Portland Metro area. The table below from the most recent RMLS report gives us the numbers, and we can see that inventory is a serious problem that got worse in 2020 and continued into 2021.

Some might have thought with recently passed increased density zoning rules in Portland, housing construction would be booming, but it is not. New home construction in the Portland real estate market plummeted in 2020 and has stayed at bottom level rates in 2021, likely due to supply and labor problems.

3. High Mortgage Loan Limits

Another COVID-19 impact is higher mortgage loan limits for 2022.

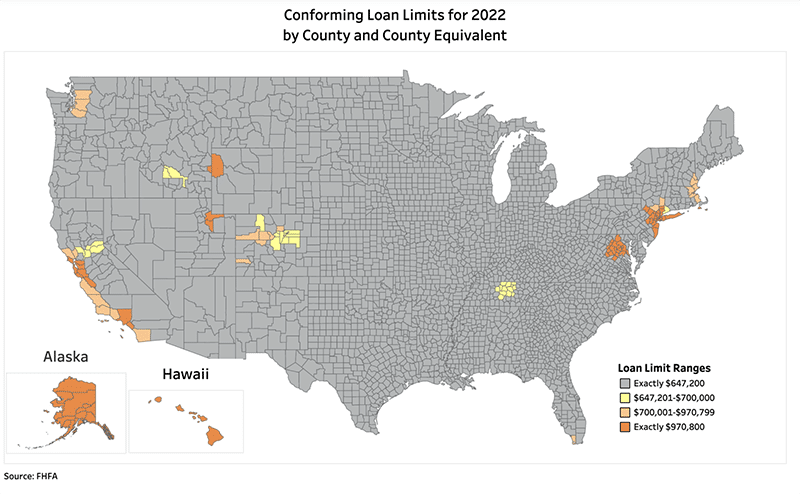

According to Realtor Magazine, a publication from the National Association of Realtors, the Federal Housing Finance Agency (FHFA) announced just this week that there will be a $98,950 increase in mortgage limits for loans backed by Freddie Mac and Fannie May from $548,250 to $647,200. This jump is in response to ever-increasing home prices during 2021 (primarily due to low inventory).

Citing an 18.5% increase in home prices nationwide between the third quarters of 2020 and 2021, the FHFA expects the same level of price increase into the third quarter of 2022, pointing out that for areas with higher median home values that exceed the baseline limit—like San Francisco and New York—conforming loan limits will be higher.

For all counties in Oregon, the limit will be $647,200 for a single-family home with multi-family dwellings increasing as follows: 2 units – $828,700, 3 units – $1,001,650, and 4 units – $1,244,850.

The map below, from Loanlimits.org, shows the distribution of the increase, with most of the country, including all of Oregon, exactly at the $647,200 mark.

Click here for a full list of mortgage rate increases per county.

3. Foreclosure Moratoriums Ending, What Happens Next?

As we reported in March of 2021, protections for homeowners in the form of foreclosure moratoriums have been in place on both federal and state levels.

These protection measures were to end June of 2021, but the Biden/Harris administration extended foreclosure moratoriums, nationally, through the end of July, 2021. After this time, the Supreme Court elected to no longer support federally approved moratoriums.

However, the Federal Housing Authority (FHA) extended theirs beyond that time to September 30, 2021. And Oregon Governor, Kate Brown, committed to keeping Oregonians in their homes, extended the foreclosure moratorium even longer through the end of 2021.

According to USnews.com, 1.75 million homeowners—approximately 3.5% of all homes—have been able to stay in their homes thanks to some sort of forbearance plan with their banks. With an end in sight, many are concerned about what’s next.

Keep in mind that the foreclosure process takes at least 120 days per federal law. Add to that the time needed for court proceedings. This alone will give homeowners facing foreclosure time to come up with other solutions.

As the article points out, banks don’t really have much incentive to put delinquent mortgages into foreclosure because in those cases, the amount owed is likely more than the overall value of the home. What is likely to happen in many cases, is loan restructuring or moving missed payments to the back end of mortgages.

4. Housing Prices Rising Slower

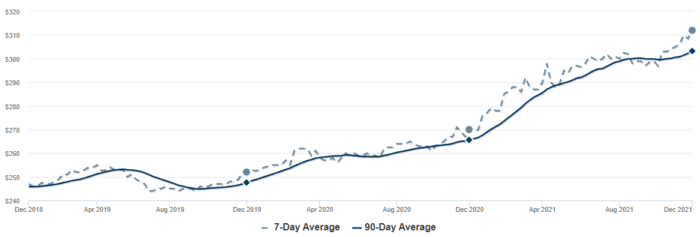

As we’ve seen in the Portland metro area, home prices have continued to climb over the past couple of years, and this has been true across the country.

According to the NAR, though, we may begin to see price increases moderate and slow down in the coming year. Others are anticipating the same, noting that while home prices remained strong in September of 2021, the pace of price increases declined slightly.

This doesn’t mean we can expect to see price drops, though, due to continuing tight inventory and high investor activity. Only that we’re likely to see a lower rate of appreciation.

The below cart from Fidelity National Title shows the increasing price per sq. ft. of a home in Portland.

5. Zoom Town — People moving to Suburbs and Small Towns in Oregon

The Pacific Northwest has been transformed into a region of Zoom towns. After COVID hit and people were forced to work from home, many discovered the benefits of such an arrangement and chose to move to areas blessed with beautiful natural settings and all the amenities that come with that.

Oregon is one of those areas, and while many have gone to Bend or Hood River or Cannon Beach, many have also chosen to move to the Portland suburbs from other states to have both city and nature access.

This of course, creates housing at a higher premium, which in turn, leads to higher real estate prices.

6. Zillow Abandons the iBuyer Game, but the Practice Continues

In our March 2021 article, we wrote about the surge of iBuyers. iBuyers are real estate companies that rely on technology for real estate transactions. What’s attractive about iBuyers, especially during the pandemic, is that all the typical human interaction we expect when selling and buying homes—meeting with Realtors, viewing homes, having volumes of strangers in and out of our homes—are removed. From the looks of things, they’re likely to stay strong in 2022.

However, as we’ve outlined before, if you want to get the most out of selling your home, iBuyers are usually not the best option. They tend charge steep fees, and they use shady tricks, like suddenly dropping the price of your home before closing. In short, iBuyers have no fiduciary duty to the public, their only goal is to make as much profit off your home as they can.

7. Property Insurance Impacted by Climate Events

The pandemic hasn’t been the only event to rock our worlds. With natural disasters like hurricanes, tornadoes, and wildfires on the rise, insurance companies have been hit hard with claims. To recoup, they’re raising premiums and reducing coverage.

One bright spot in all this is that FEMA has restructured the National Flood Insurance Program (NFIP) to take more factors into consideration, such as a home’s elevation or whether one household lives only on an upper floor of a multi-family dwelling, rather than base premiums solely on flood plane maps. They say that some may even see a drop in flood insurance premiums.

Real Estate Trends for 2022

As of early December, 2021, the NAR is projecting five real estate trends for 2022.

- Suburbs will thrive. With many people no longer needing to leave home to work, they’re looking for larger homes for office space and more peaceful surroundings.

- Millennials will become homebuyers. This age bracket will enter the first-time home buying stage of life.

- Hispanic homebuyers will increase. This demographic accounts for more than one out of 10 recent home buyers and are expected to play a big role in the home buying market.

- Affordability challenges will continue. Despite the expected slowing in the pace of home price increases, it’s projected that they’ll continue to climb. Mortgage rates are also expected to increase between 3.5% to 3.6% for a 30-year fixed-rate by the end of 2022.

Make Your Own Portland Real Estate News Story

We can watch the news to stay informed about what’s going in the larger world of real estate. We can also make choices based on what we know and make our own personal real estate stories. We’re here to help you create yours.

Over small team has helped over 2,000 customers buy or sell a home in Oregon and SW Washington, and we’d love to talk with you today. Contact our top 1% sellers agents or top 1% buyers agents and tell them your real estate story!