Portland Real Estate Bubble – Housing Crash 2022

Ever since COVID hit the U.S. economy and real estate market has been acting strange. Confusion and concern often lead the way. But despite the ups and downs over the last couple of years, the real estate market has continued to maintain strong demand as inventory has remained low (even historically so) and prices have skyrocketed. But what will happen to the Portland real estate market in 2022, will the bubble finally burst or will prices continue to rise to unseen heights?

Summer 2022 update. As we will see below, the number one impact of our currently slowing Portland real estate market is rising interest rates. However, the rest of our local economic fundamentals remain the same.

In order to understand the likelihood of a real estate market boom or bust we need to survey the structure of the local real estate market. There are two foundations with multiple pillars: ability to buy a home (employment, wages, interest rates, affordability) and ability to sell a home (inventory, home equity, population growth or decline, cost).

Ability to Buy a Home in Portland in 2022

Portland Employment – √

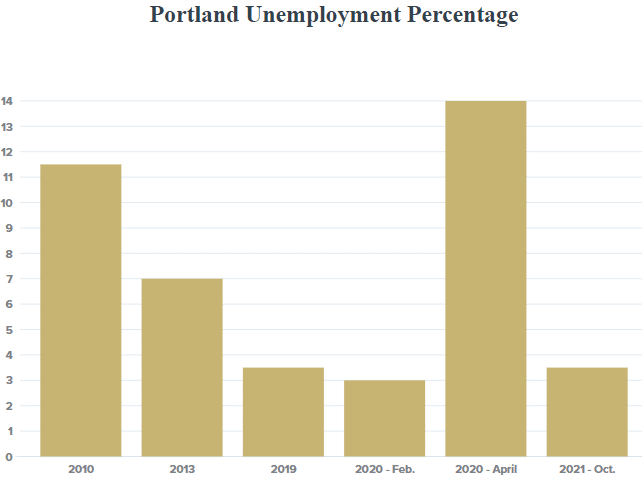

Most everyone needs steady employment to purchase a home. We all had a scare worse than in 2020 when COVID initially hit, but take a look at the fall 2021 unemployment percentage below. We are right back to where we were before COVID hit and many are predicting unemployment in Oregon will get even tighter in 2022. So in terms of employment at least, there are no Portland real estate market concerns. Numbers from the Bureau of Labor.

Portland Wage Growth – √

Wages in Portland increased faster in 2021 than in the three years prior. Portland wages increased at an annual rate a little higher than 4% in 2021 and that number for the last three years had hovered around 3%. In nearly all categories of employment Portland meets or exceeds national wage averages. Of course, it should be noted here that Portland home prices increased more than 4% in 2021, averaging 10-14% depending on the part of the city. So home affordability in the metro took a hit. That being said, the population in Portland by-in-large is employed and their wages are increasing faster now than in prior years.

Portland Rent Vs. Buy a Home – √

The Portland rental market was getting cheaper the last few years with rents declining annually due to vast apartment construction projects. Those projects are mostly finished now with few new large apartment projects on the docket, due to increased material and labor costs. Portland rental vacancy decreased in 2021. CoStar reported that amount the top 50 metro areas, Portland had the fifth-fastest declining vacancy rate, dropping to 4.7% in late 2021. Due to new, tough rental laws passed in Portland, many homeowners (smaller landlords) have stopped renting out their detached properties, adding to the fast dropping vacancy rates. This all means that rental rates are poised to increase in 2022, perhaps dramatically so.

Portland Real Estate Affordability – O

Affordability is determined not by housing price alone, but in comparing housing price with local wage averages. Portland is largely unaffordable compared to smaller metro areas, but also remains more affordable than most larger or similarly sized metro areas in 2021. Read our comprehensive 2021 Portland housing affordability rate report. When we write our 2022 version of that same report, I expect Portland housing to be slightly less affordable than in 2021, even with increased wage growth due to the ever increasing home prices forecasted for 2022.

Interest Rates – X

Interest rates have an oversized effect on the home buyers ability to afford a new home. Existing homeowners with lower interest rates are also hesitant to sell and obtain a higher rate on their next property. There is little doubt in the real estate industry that mortgage rates will rise in 2022, with most predicting an increase to 4%. This will not have a positive effect on home buyer ability to buy. However, while it is a red mark against the 2022 real estate market, it is perhaps the only one.

Ability to Sell a Home in Portland in 2022

Inventory – √

The primary reason the Portland real estate market has been a sellers market since 2016 is low inventory. Inventory is determined by two primary factors, population growth or decline and constructions rates. Construction rates in Portland have been low since the 2010 real estate crash, but in 2020-21 new home construction rates hit a new low in Portland despite dramatically increased zoning for denser housing options in the city.

Population Growth – O

Population growth in the greater Portland metro in 2021, but dropped by 11,000 people in the city proper. The population growth in the Portland metro is happening in the surrounding suburbs. Despite plenty of bad press, the city overall continues to grow.

Home Equity – √

With double digit price increases in Portland in 2020 and 2021, and significant price increases going back to at least 2014, there should be no problem for the vast majority of home owners in Portland to sell if they desired to in 2022.

Home Selling Costs – √

The cost to sell a home is down nationwide. The national average real estate commission finally dropped to just under 5% in 2021. Licensed since 2003 with over 2,000 local home sales, our team charges a max. of 4% commission to sell a home in the Portland metro area. We do not charge any additional fees and provide a cancel anytime policy. Title escrow costs have also remained stable in our area. Seller closing costs (separate from buyer closing costs) are relatively. See our breakdown on sellers closing costs in the Portland area.

What about foreclosures? Aren’t they coming to crash the party in 2022?

No. You can see the Portland 2021 foreclosure report we wrote in July here. At that time the mortgage forbearance rate was 3.91% and now at turn of the year, it is down to under 2% nationwide. Mortgage forbearance rates tell us how many homeowners are behind in their payments. Simply put, hardly any, certainly not enough to cause a real estate market crash nationally or locally.

Will the Portland Real Estate Market Crash in 2022?

Not a chance. At least not when considering the local Portland economy, looking at the factors that dictate a strong or weak real estate market here. Of course, broader national or worldwide economic effects are beyond our scope. There is no guarantee the real estate market will not crash in 2022, but when we look solely at the local economic forces, there are simply no factors that would cause a bubble burst or crash. If you’re considering buying or selling a home in Portland, our top 1% team would love to speak with you today. Give our main line a call at 503-714-1111 or chat with our bot on this site.