Step by Step Guide to Buying a Home in Portland

12 Steps to Buying a Home in Portland, Oregon

We have written many other articles on the home-buying process in the Greater Portland metro area, but this article is a great place to start.

Licensed since 2003, I watch the Portland real estate market like a hawk and write monthly reports on how it is currently affecting home buyers and sellers. In order to keep tabs on the local real estate market, we recommend you bookmark this page. I would also encourage you to sign up for our 2X month blog digest (you can sign up on this page, scroll down or look to the sidebar), and make sure to understand the best time of the year to buy a home.

Buying a home is a big decision, in most cases, a life-changing decision. A home purchase impacts practically every aspect of your life, particularly your finances. So it’s important to understand the home-buying process so that you are properly positioned, ready, and equipped to make informed decisions.

This article will guide you through the 12 essential steps to buying a house in the Greater Portland metro area. Whether you are a first-time homebuyer or looking to move within the area, gaining a comprehensive understanding of these steps will empower you to make informed decisions and confidently navigate the local real estate market. Before you start you might want to check the latest financial rent vs. buy estimator and the latest Portland housing affordability chart.

Step 1: Check your Credit Score (it’s free)

The role of credit score in the home-buying process

Now that we have set the stage, let’s dive into the first step:

Credit Score Check. Understanding the importance of your credit score and how it affects your ability to secure a mortgage is crucial.

Your credit profile and score are among the three most critical aspects of qualifying for a home loan. Without going into too much detail, I’ll share with you an acronym that lenders use to describe the foundational elements needed to qualify for a home loan: They call it “The three “C”s”- Credit, Collateral, and Capacity.

Credit: Your credit history and your credit score

Collateral: The property you are purchasing

Capacity: Your ability to repay the loan. That is your income and assets.

Minimum Credit Scores Needed to Get a Home Loan

- FHA Loan – 580

- VA Loan – No requirement

- Conventional Loan – 620

How to check your credit for free.

You can use a couple of services to get a quick idea of your credit and credit scores.

The first and most recommended resource is annualcreditreport.com – the designated and authorized website for consumers to receive free annual credit reports, a right guaranteed to consumers by Federal law. It serves as the central platform where individuals can access their credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion. At AnnualCreditReport.com, you can get a copy of your credit information and review it for accuracy. You can also request your credit score, although there is a small fee for that additional service, but well worth it.

Secondly, you can use other services such as CreditKarma and others provided by your credit card companies and your bank. Most of these are also free services, although they do have a commercial intent, which is to sell you credit-based products and services such as loans and credit cards.

Quick note, we are not a lender of any kind and this is article is not an offer for a loan. We are happy to recommend a good local lender.

Step 2: Down Payment and Closing Costs

The role of down payment requirements and closing costs in a home purchase

Almost invariably, a home purchase involves the buyer paying a down payment and closing costs. The downpayment is a percentage of the purchase price the buyer brings to the closing and gives the lender the assurance that the buyer has a vested interest in the property.

Closing costs are fees and charges the borrower has to pay for services associated with closing on a home purchase. The amount of fees varies based on factors such as the type of home being purchased, the type and amount of the loan, and more. We write regular reports to help you estimate your home buying closing costs.

Review of different loan programs and their down payment requirements

Generally speaking, buyers will have a choice of loan programs with varying down payment requirements. Range of down payment amounts can be as low zero down for certain programs up to whatever percentage the buyer is able to provide for a down.

Typically, lending is divided into two major classifications: Conventional and Government loans. Within those two classifications, there are quite a few programs to choose from; we will cover the most common programs used in the Greater Portland metro area.

Conventional Financing;

Conventional loans typically require a larger down payment than government loans. Usually between 5 to 25% down depending on parameters such as investment or owner-occupied purchase, credit profile, and the type of property being purchased.

Government Financing;

Government loans generally fall into two categories; FHA and VA Loans.

FHA Loans

FHA financing is one of the most commonly used types of loans by those buying their first home. The down payment requirement is as little as 3.5% down. The small down payment can even be a gift from a qualified donor or a loan from a qualified institution.

VA Financing

VA loans are some of the most favorable financing options for those who qualify. VA requires zero down payment, and the interest rates are very reasonable considering the perceived risk of financing a buyer with no down payment.

Explanation of closing costs and how to estimate them

Buyer’s closing costs typically range from 2% to 5% of the home’s purchase price. These costs include lender fees, appraisal fees, title insurance, attorney fees, and other expenses. To estimate closing costs, you can request a loan estimate from your lender, which outlines the anticipated costs associated with the loan.

Step 3: Working With A Buyer’s Agent

Role and benefits of having a buyer’s agent

Having a buyer’s agent by your side is a valuable asset throughout the home-buying process. Interestingly enough, the role of a buyer’s agent is often not fully understood, leading to some confusion as to what a buyer’s agent does. So let’s fully clarify that:

What is a buyer’s agent?

A buyer’s agent is a licensed real estate professional who works exclusively on behalf of the homebuyer throughout the purchasing process. Their primary role is to advocate for the buyer’s best interests and provide a smooth and successful home-buying experience.

It is important for buyers to be clear on how a buyer’s agent is different than a seller’s agent and, most importantly, a dual agent. In all real estate transactions, an agent typically represents the seller. Buyers need to understand that the seller’s agent is contractually obligated to the seller and their obligation is to help the seller get the highest and best offer for the seller. You should also be aware that the seller’s agent has a fiduciary duty to the seller.

We have one of the top buyers agents in the greater Portland metro area on our team. Call her office today at 503-773-0000 to schedule an appointment where she’ll get to know you, your loved ones, and what type of home you’re hoping to find.

The buyer’s agent role gets a little muddy when a dual agent is involved; this is where the same agent that represents the seller also represents the buyer. When buyers go directly to the listing agent, often because they feel they will get a better deal or a better chance of buying the property, they are then dealing with a dual agent.

One of the most important steps when buying a home is to find your own agent, someone who exclusively represents your interests.

How to find a reliable and experienced agent

Finding the right buyer’s agent to represent you should be given serious consideration, after all, you are making an investment that will change your life in many ways and is usually the biggest purchase of your life. You want someone who will give you the best possible guidance through this important step of your life.

Research Online: Search through reputable real estate websites, directories, and review platforms to search for agents in your desired area. Look for agents with mostly positive reviews (no one can make everyone happy) and track records of successful transactions.

Interview the Buyers Agent: Schedule a consultation with your prospective buyer’s agent. This allows you to evaluate if their communication style and expertise matches your needs and personality.

We’ve created a helpful article for you, 5 Questions to Ask When Interviewing a Buyers Agent.

Step 4: Mortgage Preapprovals

Why getting preapproved for a mortgage is so important

Having your financing in place to buy a home is an absolute must in Portland’s busy real estate market. There are several reasons it is imperative to be preapproved; let’s review them.

Some Sellers and their Agents require it.

Practically every home seller in the real estate market will want to see a loan preapproval and many will want to see proof of funds for the down payment and closing costs attached to the offer. If you want your offer considered, then you need to get pre-approved.

Preapprovals give you a clear understanding of the financing terms

When you are preapproved for a loan, you will have a detailed estimate of your monthly payments, closing costs and other financial details of the transaction. This should give you great peace of mind since you know exactly what to expect if the offer gets accepted.

Smooth transaction process

When you submit an offer on a home and your financing is already in place, the closing of the purchase is much easier. By the time your loan is finally approved (goes through the underwriting process), you have submitted everything to the lender to process your loan, the only items that will be outstanding are related to the property, such as appraisals and title, and the contracts.

Getting preapproved

To get pre-approved for a mortgage in Portland, here is what you will need to do:

First, gather your financial documents, including income statements, bank statements, tax returns, and identification documents.

Next, research and select a lender that offers mortgage programs suitable for your needs. Call my buyer’s agent’s office at 503-773-0000 for a list of highly recommended local mortgage lenders. Complete the lender’s mortgage application form (this often can be done online), providing accurate and comprehensive information about your finances, employment, and debts. The lender will perform a thorough credit check and review your documents to assess your creditworthiness.

If you meet the lender’s criteria, you will receive a preapproval letter stating the amount you are preapproved for. Working with a trusted buyer’s agent can help guide you through the process and provide valuable insights specific to the Portland real estate market.

Step 5: Researching Portland Neighborhoods and Areas

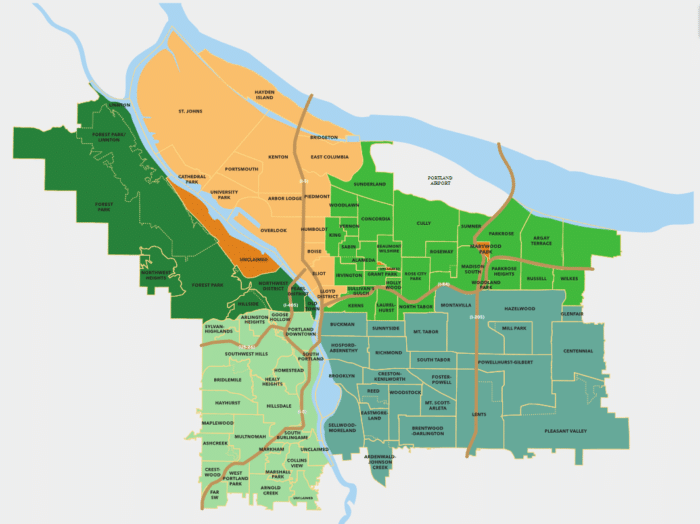

We highly recommend the clickable Portland, Oregon neighborhood map found at PortlandNeighborhood.com. The local neighborhood guides found there are second-to-none and are regularly updated.

Importance of researching neighborhoods before buying a house

Before committing to a house, you should make sure the neighborhood meets your expectations. Buying a home in an are usually means a commitment of several years so you want to make sure certain aspects of the area align with you and your family’s life style.

Factors to consider when evaluating neighborhoods

As you research different Portland areas and neighborhoods, here are some things to consider:

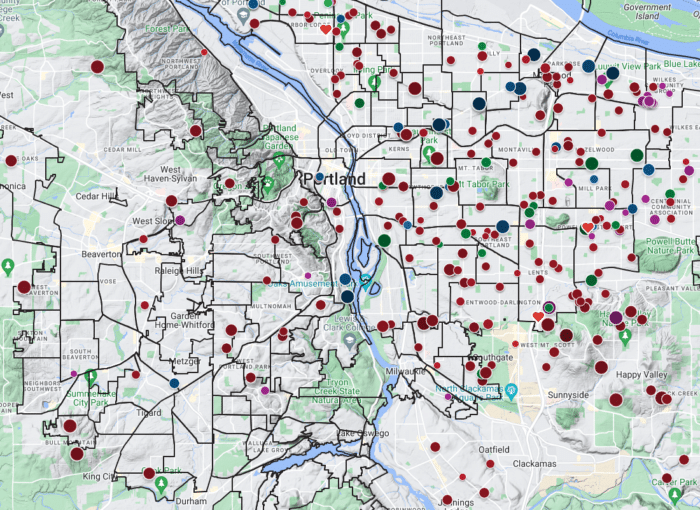

Safety and Security. Real estate agents can’t talk advise on this, but can point you to the proper resources. For the city of Portland, there is no better resource to check than the Portland Police Crime Map.

Location and Accessibility: Consider the neighborhood’s proximity to your workplace, schools, transportation options, and major highways. Long commutes are not always as easy as it may seem, and considering the high price of fuel in some places, this could definitely impact your budget.

Quality of Schools: If you have or plan to have children, the quality of the local schools is a big consideration. Look into school ratings, programs offered, and extracurricular activities. Again, this is not something your real estate agent can help with, but we can point you to local resources like the Oregon School Report Cards. We have created a whole category of articles about school ratings, where to find them, and how they impact home values.

Amenities and Facilities: Give serious consideration to the availability of amenities that are important to you, such as parks, recreational facilities, shopping centers, restaurants, medical facilities, and community services.

Community and Culture: Consider the community atmosphere, cultural diversity, and sense of belonging within the neighborhood. Look for local events, organizations, and initiatives that promote community engagement. Check out PortlandNeighborhood.com for this, as each individual neighborhood guide typically includes their local community links.

Future Development: Research any planned or potential future development projects in the area, as they can impact property values and the overall neighborhood character. This is often an overlooked part of researching an area and could have surprising consequences. NextPortland.com is the best site for this and contains an easy to use clickable map.

Step 6: Understand the Local Real Estate Market You’re Buying In

Most of the big news portals do a terrible job covering the real estate market and their articles are filled with sensational headlines and content. We recently wrote an article listing out the top ten real estate news sources we trust and follow.

It is also important to understand that in general there is a best time of the year (even month) to buy a home and a best time of year to sell. There is a part of the year in Portland, Oregon that always favors sellers, and a part of the year that always favors buyers. Read our regularly updated reports on that to learn more.

We run a top 100 real estate blog in the world and send out a free twice-a-month email digest on our articles. You can sign up for free here. We only ask for your email so we can send the digest.

Step 7: Searching for Homes for Sale

Start shopping. We highly recommend PortlandHomesforSale.com. It has a direct connection to our local MLS which makes it faster and more accurate than national portals. It also has many unique search filters that can’t be found anywhere else.

Pocket and Coming Soon Listings

Know the local rules on coming soon and pocket listings and ask your agent to help give you a heads up on homes before they hit the market.

Step 8: Touring Homes

Once you have identified an area for your next home and have a list of homes for sale from your agent or from your online homes for sale searches, it’s time to prepare for in-person tours.

How to prepare for house tours

Define Your Priorities: Decide on your must-haves, preferences, and deal-breakers. This will help you focus on homes that align with your specific requirements and save you time looking at homes that don’t meet the requirements.

Set a Schedule: Work closely with your agent to plan your house tours in advance and allocate enough time for each property. Nearly everything is scheduled online through your buyer’s agent.

Bring a Checklist: Prepare a checklist of features and aspects you want to assess in each house. This will help you compare properties and make sure you don’t miss important details.

Take Notes and Photos: You will be looking at at least a few homes, so make sure to bring a notebook or use a note-taking app to jot down observations, pros, and cons of each home. Take your own photos to aid your memory and help with comparisons later.

Step 9: Making an Offer

Before you make an offer, if the home is located in the city of Portland (not a suburb), but that home’s address in at Portlandmaps.com. You will get a wealth of historical information on that home you might not be able to find anywhere else.

Making an offer on the home of your choice is one of the most exciting steps in the home-buying process. It is also a process that requires having a good strategy since oftentimes, you only get one shot at getting it right. Here are the steps you can take to improve the possibility of getting your offer accepted in the Portland metro area:

Review of the process of making an offer on a house

Consult with Your Buyer’s Agent: Seek advice from your buyer’s agent to understand the local market conditions, recent comparable sales, and the seller’s situation. Often the buyer’s agent will call the seller’s agent to get what information they can.

Determine Your Offer Price: Evaluate factors such as the home’s condition, location, and time on market. Consider comparable sales in the area to arrive at a reasonable offer price. Your agent will be a great asset in helping you in this area.

Draft the Offer: Work with your buyer’s agent to prepare the offer letter, which includes the offer price, proposed contingencies, desired closing date, and any additional terms or requests.

Submit the Offer: Once the offer is ready, your agent will send the offer to the seller’s agent to be presented. Your agent will advise you of any additional documents that the seller requires, such as pre-approval letters and proof of funds to close.

Negotiation Strategies and Tactics

Negotiating the terms of an offer is a crucial aspect of the home-buying process. This is an area where an experienced buyer’s agent can make all the difference.

Consider the following strategies and tactics when making your offer:

Start with a Strong but Reasonable Offer: Begin with an offer that is competitive yet within your budget. This shows your seriousness as a buyer and sets a positive tone for negotiations. If you start too low it might offend the seller. A low offer typically is any amount less than 10% of the seller’s asking price. If asking price is much higher than you want to pay, might be best to move on, or wait for the price to drop on its own.

Focus on Non-Price Terms: Aside from the offer price, consider including favorable terms such as a flexible closing date or specific contingencies that benefit both parties. In some cases, these non-tangibles have made the difference between an offer being accepted or rejected.

Be Ready for Counteroffers: Unless you’re offering full price or better, expect a counteroffer. Keep in mind the seller’s counteroffer will come with a timeline to respond.

Remember, negotiations are a give-and-take process. Be prepared for compromises while staying focused on your priorities. With a well-crafted offer, a thoughtful approach, and effective negotiation strategies, you can position yourself for success and increase your chances of securing the home at a favorable price and terms.

Step 10: Handling Home Inspections

The Role of Home Inspections:

Home inspections play a crucial role in home buying. Inspections are conducted by qualified professionals who assess the condition of the property, identify potential issues, and provide you with a detailed report. We recommend you never waive the home inspection. The buyer typically pays the full cost for the home inspection. Expect to budget $500 to $2,000. The general home inspection can last two to six hours.

Here’s why home inspections are so important:

Uncovering Hidden Problems: Inspections reveal any underlying issues that may not be visible during a casual walkthrough. This includes structural problems, safety concerns, or hidden damage.

Informed Decision-Making: The inspection report gives you a comprehensive understanding of the property’s condition. It helps you make an informed decision about whether to proceed with the purchase, negotiate repairs, or reconsider your offer altogether.

Negotiation Power: If it happens that significant issues are uncovered during the inspection, you can negotiate with the seller to address those concerns. This can potentially lead to repairs, concessions, or adjustments in the purchase price.

Note that sellers may ask that an inspection be waived in today’s competitive real estate market. While an inspection is optional, you are highly encouraged never to waive a home inspection.

There are quite a few types of home inspections you can request. These are the most typical and necessary inspections in the Portland area:

General Home Inspection

This type of home inspection is comprehensive and covers the property’s overall condition, including the structure, plumbing, and electrical systems, heating and air conditioning components, a visual inspection of the roof, and more.

This a list of common additional inspections buyers request:

Radon Inspection: Radon is a colorless, odorless gas that can be harmful if present in high levels (cause cancer). A radon inspection measures radon levels in the property and determines if mitigation is necessary. See our updated Portland Radon Map.

Sewer Line Inspection: This is typically a pass or fail test, where they run a camera through the line to check for breaks or blockages. Here is our guide on that.

Tank Sweep: Finding a buried oil ground tank that has been leaking can be one of the worst results from a home inspection. Properly decommissioning a leaking oil tank is expensive and required by Oregon law. Here’s our guide on how much it can cost to decommission an oil tank.

Mold Inspection: This inspection identifies the presence of mold or conditions conducive to mold growth. It helps evaluate potential health risks and the need for remediation. In the PNW home mold is a major problem. Read our guide on local mold testing options.

Roof Inspection: A specialized inspection that assesses the condition of the roof, including its age, material, and any signs of damage or leaks. A general home inspection report may have revealed that the roof may be showing signs that it needs replacement. The next step is to get a few roofing companies to take a look. Keep in mind, many roofers simply say a new roof is required because they want the job, so it is important to get a few different opinions. The roof may last for many more years with proper maintenance.

Finding qualified home inspectors

Your buyer’s agent will be able to point you in the direction of qualified home inspectors for any type of inspection needed. You will probably receive at least 2 or 3 different names you can choose from.

You can also search local directories such as Yelp to find inspectors. Keep in mind that your agent will need to be informed of the process so they can coordinate inspections with the seller’s agent as needed.

Reviewing inspection reports and addressing issues

Once you receive the inspection report, make sure to review it in detail. A reply to the inspection is usually needed per the contract, whether that be an acceptance of the report or a request for repairs. Consider the following steps:

Understand the Findings: Pay attention to the inspector’s notes, recommendations, and any areas of concern. Seek clarification if you have any questions or need further explanation.

Prioritize Issues: Assess the severity and potential impact of each identified issue. Determine which ones are major concerns that require immediate attention and which ones are minor and can be addressed over time.

Negotiate Repairs or Credits: Work with your buyer’s agent to negotiate with the seller based on the inspection findings. You may request repairs, a reduction in the purchase price, or a seller credit to address the identified issues. Keep in mind, the inspection period is not in place so buyers can ask the seller to remodel the home or provide upgrades, it is a contingency to request repairs on defects or credits for repairs.

Step 11: Home Appraisals

Explanation of the appraisal process

Appraising the home is a required step in the home-buying process that determines the property’s fair market value. Appraising the property is not only a prudent step for you as a buyer but also a requirement by the lender for home financing. The buyer typically pays the entire cost of the appraisal, expect to pay $800 to $2000. The home appraiser typically walks through the home in thirty minutes or less.

Here is the typical appraisal process:

Selection of an Appraiser: The lender requests an appraisal company to assign a licensed appraiser. Typically this processes is randomized, so no one gets to pick a particular person and skew the results.

Property Inspection: The appraiser visits the property to assess its condition, size, features, and overall quality. They take measurements, note any upgrades or renovations, and evaluate comparable properties in the area.

Appraisal Report: The appraiser compiles their findings into a detailed appraisal report. The report includes information about the property, the analysis of comparable sales, and the final appraised value. Note here that the appraiser often just writes in the offer price if their final value is close enough.

Potential Outcomes of the Appraisal:

Once the final appraisal report is prepared, it can result in three potential outcomes:

Appraised Value Meets or Exceeds the Purchase Price: When the appraised value matches or exceeds the agreed-upon purchase price, it validates the contract and provides confidence to both the buyer and the lender.

Appraised Value Falls Short of the Purchase Price: If the appraised value is lower than the purchase price, it creates difficulty. The buyer can bring in cash to make up the difference, the seller can reduce the price, or a combination of both. The seller can also challenge the appraisal results, which can result in an adjustment. The buyer can typically also choose to get a different loan so that a second appraiser comes out and has a chance to meet value. The buyer can also typically walk away from the transaction and get their earnest money back in full. Licensed since 2003, I’ve seen all of the above.

Appraised Value Contingent on Repairs or Conditions: In some cases, the appraiser may identify issues that affect the property’s value. The appraisal report may require repairs or specific conditions to be met before finalizing the appraised value. This is another headache as the condition often comes only a few days before closing and it might be difficult for the seller to make those repairs in time, if the seller is willing to do so.

Step 12: Closing on Your Home Purchase

By the time you get to closing, you should be exhilarated to finally complete the home purchase! Chances are you have been through a roller-coaster of emotions and it’s time to take care of the final steps before you move into your new home.

The closing process in Oregon involves the final steps necessary to finalize the loan, deliver funds to settle the file and transfer ownership of the property to the buyer. We have a whole category of articles on deeds, title, and escrow.

Final loan approval

Once all the loan conditions have been met and the lender is ready to close, they will issue a “clear to close” status. They will then prepare and deliver your loan documents to the closing agent, usually the escrow company.

Funding and Recording

Once you have signed your loan documents and they have been reviewed and accepted by the lender, they will wire funds to close on the home purchase. The title company will record the mortgage and the title transfer at the local county recorder. The legalities of the contract are now completed, and you are officially the new owner of that property.

Delivery of Possession

The contract you signed had a clear stipulation on the timeframe to deliver possession of the home to you. Your buyer’s agent will arrange to deliver the keys to you so you can move in and enjoy your new home.

Work with a Local Real Estate Expert

Kami Price, Principal Broker in Oregon has been licensed since 2004 and has helped hundreds of home buyers find their next property. There is no one I trust more with my clients. She has a long list of degrees, certificates, and awards. Call her office today at 503-773-0000 to schedule your no obligation home buying consultation. She’d love to connect with you today!